Business Planning,

Strategy & Execution

Financial Projections

And Analysis

International Business

Opportunities

About Us

strategic CFO services for business success

Our CFO services are designed to equip Texas businesses with the financial expertise needed to thrive in a competitive market. Whether you're a startup, a growing company, or an established enterprise, our CFO professionals provide strategic financial planning, cash flow management, and risk assessment to help you achieve sustainable growth.

With our expert guidance, businesses gain access to data-driven insights that improve profitability, streamline budgeting, and enhance decision-making. We work closely with you to develop customized financial strategies that align with your business goals, ensuring long-term stability and success. By leveraging our CFO services, you can navigate financial complexities with confidence, optimize resources, and drive your business forward.

Our Bookkeeping Services In Texas

Crunching the Numbers

Giving You Time

Our best CFO services in Texas provide the financial expertise your business needs while freeing up your time to focus on growth. Managing financial strategies, cash flow, and forecasting can be overwhelming, but with our expert CFO support, you no longer have to worry about handling complex financial decisions alone. We take care of everything—from financial planning to risk management—so you can concentrate on running your business with confidence.

Stress-Free Management

With our fractional CFO services, you gain access to top-tier financial leadership without the commitment of a full-time hire. Whether you need assistance with budgeting, performance analysis, or financial reporting, our experienced CFOs ensure that your business stays financially healthy and well-structured. No more stress about inaccurate forecasts or cash flow issues—we provide strategic financial guidance that keeps your business on track for sustainable growth.

No Surprises

As a leading provider of CFO consulting services, we bring clarity to your financial operations, ensuring there are no unexpected financial setbacks. Our proactive approach helps businesses stay ahead by preparing for audits, tax season, and long-term financial planning. With accurate forecasting, data-driven insights, and expert financial strategies, you’ll always be in control, ready to make informed business decisions without surprises.

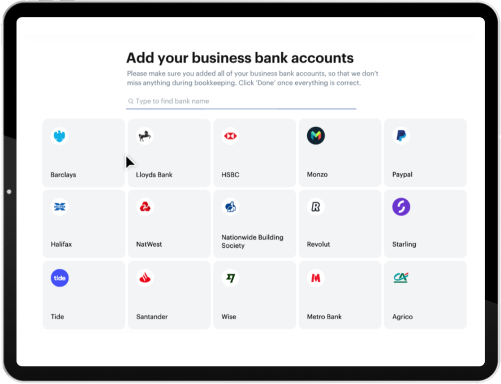

Software Expertise

Simple Software

Easy-to-use Tools to Handle Your

Bookkeeping & Finances

01

Bookkeeping to Tax Filing

With end-to-end support, Accounting Express manages your financial records daily and organizes everything needed for tax filing, ensuring compliance and reducing last-minute stress. This full-spectrum service minimizes errors and maximizes deductions, providing peace of mind as tax deadlines approach.

02

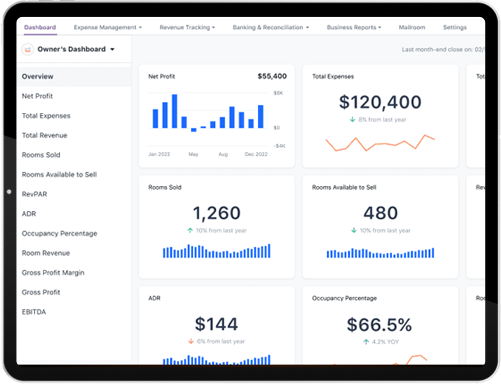

Real-Time Data

Real-time updates give you immediate visibility into your finances. This feature empowers you to monitor your income and expenses as they happen, allowing for quick adjustments and better management of day-to-day business decisions..

03

Clear Cash Flow Visibility

A clear view of cash flow helps you understand inflows and outflows, ensuring you’re well-prepared for upcoming expenses or investment opportunities. This insight into liquidity allows more accurate planning, keeping finances stable and predictable.

04

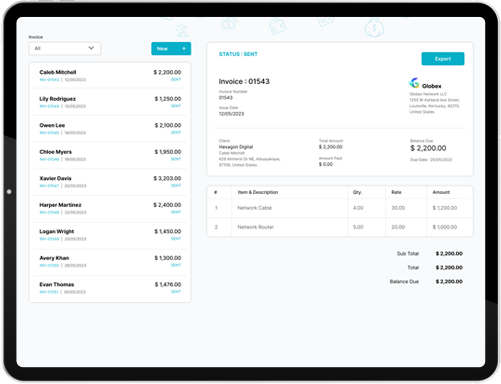

Accelerated Invoice Processing

Faster invoice handling speeds up payment collections, supporting stronger cash flow. By minimizing processing time, you reduce delays, making it easier for clients to settle invoices and improving cash availability for business operations.

05

Direct Accountant Access

With dedicated accountant support, you can ask questions, receive tailored advice, and address urgent issues immediately. This direct line to a professional simplifies complex matters, giving you confidence in managing financial challenges.

Financial Management:

Just the Tip of The Iceberg

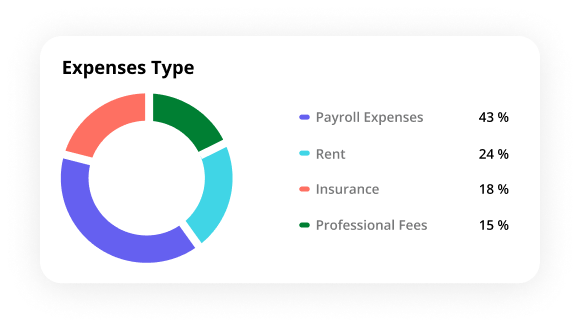

We're not just a replacement for your financial department. We ensure every cent is

spent correctly to eliminate waste and make your business healthy.

Pricing & Plan

We Deliver Perfect Pricing

and Plan Just For You

We offer packages to help you record transactions, manage your accounts, and achieve financial wellness. Choose from a variety of options to fit your business needs.

- Personal CFO Consultation

- Cash Flow Management

- Annual Budget based on Industry specific variables

- Financial Statements

- Monthly Variance Analysis & Reporting against Annual Budget

- Board Meeting Presence

$1400 /Year

POPULAR

- Personal CFO Consultation

- Budget based on Industry specific variables

- Financial Statements

- Variance Analysis & Reporting

- Board Meeting Presence

$3000 /Year

How We Work

01

Tailored to the Business

We adapt to your business needs, providing a personalized approach for accurate financial statements and reports.

02

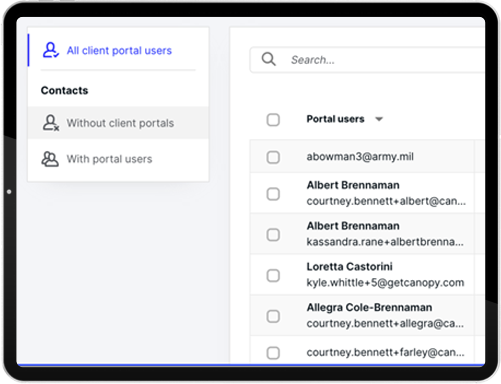

Streamlined Processes

We use simple tools like portals and CRM systems. You can reach us easily, whenever you want.

03

Data Accuracy

We prepare monthly and quarterly statements to show how your business is doing and help you plan with accurate financial data.

Testimonials

It's okay if you need to verify what we say. That's just good business sense. Anyone who works with

us once continues to work with us. Have a look:

Love What

You See?

Let’s discuss your project and find out

what we can do to provide value.